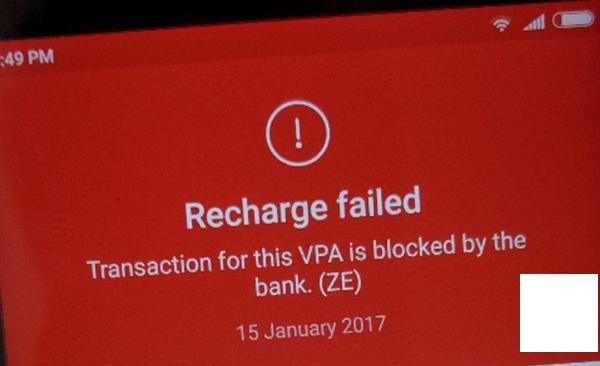

您的当前位置:首页 > Twitter > ### ICICI Bank Restricts PhonePe Transactions**Update: ICICI Bank Imposes Blocking on PhonePe Transactions**In a recent development, ICICI Bank has initiated a block on transactional activities processed through PhonePe. This move is sure to have a significant impact on users of the digital wallet service.### Key Points:- **Immediate Restriction:** ICICI Bank has introduced a temporary limitation impacting all transactions originating from PhonePe.- **User Implications:** Customers attempting to complete transactions via PhonePe may encounter difficulties.- **Next Steps:** This action could lead to further investigations or regulatory measures within the financial sector.Stay tuned for more updates as this situation continues to evolve. 正文

时间:2024-09-21 03:48:51 来源:网络整理 编辑:Twitter

ThetechgiantFlipkartsnaggedtheinnovativepaymentstart-up,PhonePe,in2016'sspring.AUPI-drivengem,PhoneP

The tech giant Flipkart snagged the innovative payment start-up, PhonePe, in 2016's spring. A UPI-driven gem, PhonePe, runs under the wing of YES Bank, granting users the power to seamlessly link and manage their banking affairs. Bank-to-bank exchanges become nearly instantaneous with the touch of a button, courtesy of a simple phone number or an exclusive identifier—your Virtual Payment Address (VPA).

But, there's more! PhonePe isn't just a transaction wonder. It's like carrying a digital wallet of your own with effortless wallet-to-wallet swaps, quicker refunds, and cashback opportunities from valued merchant partners. With a simple link, you can transfer your wallet's surplus directly into your checking accounts.

Since last Friday, ICICI Bank has taken a stand, halting transactions via Flipkart's Payment App PhonePe, highlighting safety concerns. PhonePe CEO, Sameer Nigam, aired his disapproval on Twitter in response.

Yet, ICICI Bank made their stance clear:

“This entity (PhonePe) adheres to practices that bolster its exclusive use, which contradicts UPI's principles of interoperability and customer choice to pick any payment app under UPI. Until these issues are resolved, we have temporarily suspended processing UPI transactions from this源自该实体。”

With anticipation, the National Payment Corporation of India (NPCI), the governing body of the United Payment Interface, aims to scratch this itch in the near future.

Absolutely! Please provide me with the原有text you'd like to have revised, and I'll integrate the new content accordingly.2024-09-21 14:22

Title: 15 Secret Features, Tips, and Techniques of the Vivo NEX You Ought to Know!2024-09-21 13:46

Introducing the upcoming Micromax Canvas Turbo A250: A Sleek, Full HD Display Smartphone Now Available for Pre-Orders [Exclusive Leaked Scoop]2024-09-21 12:26

Honor 5C Real-World Performance Analysis2024-09-21 12:09

WhatsApp Report & Exit: A Guide to What You Can Expect Beyond Leaving the Group2024-09-21 13:47

Does the Honor 5C Offer Substantial Battery Life for Everyday Use?2024-09-21 13:31

Enhance Graphics Superpowers with Manual Refresh Rate Control on OnePlus Nord, OnePlus 8, and OnePlus 8 Pro2024-09-21 12:33

The Lenovo Vibe C Has Debuted in India at anImpressively Affordable Price of Rs. 6,9992024-09-21 11:50

The anticipated Android 4.4 KitKat Update for the Micromax Canvas lineup is scheduled to roll out in the second quarter of 2014.2024-09-21 11:46